Left Unchecked – The Carbon Price Goes to Infinity

The article below was written by Lawson Steele – Joint Head of Carbon & Utilities Research at Berenberg Bank.

He has been in the carbon game since 2004 and it was published on his LinkedIn page on January 20, 2022.

Overview

I thought it high time to write an in-depth article on my favourite subject – EU ETS carbon, don’t you know.

Carbon has been a 10-bagger since I went on the bull path in January 2018.So it seemed poignant to ask two questions:

Does that mean it’s run is at an end?

Has the buy case ended or crumbled?

I’ve done a lot of work to retest the carbon buy thesis I’ve held for four years. The answer to both questions is an unequivocal NO.

The fundamentals still stack up and there is much more to come. So, if you have time, and the inclination, grab a coffee, sink into a comfy chair and here goes…

A more bullish view on the EU ETS carbon price

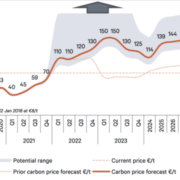

I have increased my average carbon price by 46% over 2022-30. I now forecast a peak of €150/t (previous €110/t) in Q123, closing this year at €130/t (€110/t).

Even without the Fit for 55 package, I expect the EU ETS carbon price to breach the €100/t barrier in the coming months (from the current €80/t).

In fact, I think it is highly likely that the price will go well north of my average €118/t 2022 target (the grey area and pointy arrow in the chart below).

The EU ETS carbon price could double, triple or quadruple (EUR/t):

And a much higher carbon price makes sense. Since the EU ETS scheme began in 2015, Industry has done virtually nothing to reduce its emissions.

If the EU’s goal is to reach the 55% emission reduction by 2030, which it clearly is, then the carbon price has to be sufficiently high to trigger that behavioural change.

Carbon at €80/t simply does not do that. And that is why all the EU’s reforms (MSR and Fit for 55 Green Deal) of the ETS are designed to do just that.

So let’s take a look at the fundamentals.

Revisiting my carbon bull case: stick

I stick with my bullish stance as I revisit and retest the fundamental buy case for carbon. Yes, carbon has been a 10-bagger since I turned bullish in January 2018 at €8/t. But that in itself does not necessarily stop it being, for example, a 20-bagger.

I revisit my view and conclude that it still holds true: carbon allowances are becoming increasingly scarce. Companies under the scheme will have to pay up for the right to pollute.

Which is precisely what the EU ETS is designed to do: send a price signal to force companies to reduce their emissions, ie to save the planet and protect the scarcest resource – my, and your, atmosphere.

Three reasons for entities to buy EU ETS carbon allowances

Any company or investor will have different priorities, but, for non-compliance entities, there are three main reasons to own EU ETS carbon allowances. Compliance entities have these three reasons plus, of course, having to buy allowances to comply/offset their emissions. These are:

to potentially earn a significant return: double, triple or quadruple the current price;

to contribute to a greener planet, forcing companies to reduce their carbon emissions; and/or

to protect the company against higher costs/inflation triggered by a higher carbon price.

If companies are short allowances, it is going to hurt

Sooner or later there will be a carbon cost associated with every transaction on the planet. Today, only 25% of the world’s daily 135mt of CO2 emissions is under a carbon scheme. And one scheme dominates: the EU’s Emission Trading Scheme (ETS).

As a corporate, if you do not own carbon allowances, whether for EU ETS compliance or for net zero targets, you are short. Doing nothing to cover your carbon emissions (whether direct or indirect) is effectively running a short.

A higher carbon price is going to come back and bite you. The same applies to individuals who will ultimately pay the lion’s share of the costs of carbon reduction.

COP26 was a failure to the planet

Non-specific coal reduction targets (eg “phase down” rather than “phase out”), agreeing to meet again next year to pledge further cuts (which was ostensibly the goal of COP26).

China pledging to reduce emissions from 2030 (but no discussion of the increase prior to that) and become net zero by 2060 (really?), and India targeting reaching net zero only by 2070 (oh come on, be serious) all means that the onus on saving the climate falls upon regulated emission trading schemes worldwide, of which the EU ETS dwarfs all others combined.

Consumers and corporates will have to do their bit. Politicians have thus far done very little to organise emission reduction strategies. Fortunately, EU politicians are, by and large, becoming ever greener.

There is a massive green push at the EU

The EU has shown that it is serious about reaching its 2030 emission reduction targets. Political momentum is to cut more emissions – and earlier than planned. Hence the EU Commission’s Fit for 55 package currently being debated in the EU.

It is all about tighter targets, not the status quo (let alone an easing). And the Commission is trying to speed up implementation.

Some resistance is to be expected

Of course, there has been (since the scheme began in 2005, and Kyoto 1997), and is always going to be, opposition to a higher carbon price. This has been a perennial debate since inception with Poland being one of the most vociferous (despite getting the lion’s share of carbon revenues, €8bn+ at current prices – year in, year out; see chart at end of article for full country breakdown.

To avoid legal paralysis, on 1 November 2014 the EU changed the original voting mechanism for legislation (ie not just for the EU ETS) so as to be able to sideline unreasonable opposition.

Article 16 of the Treaty of the EU stipulates that the conditions for a qualified majority are:

a majority of countries: 55% (comprising at least 15 of them), or 72% if acting on a proposal from neither the Commission nor from the High Representative; and

a majority of the population: 65%.

Poland makes yet more noise, but the argument is flawed

On 9 December 2021, the Polish Parliament passed (54%) a resolution to put forward a motion at the next EU Council meeting to suspend the EU ETS. The EU ETS is the “cornerstone policy” of the EU in its fight against climate change. I do not believe the Polish views will derail this train.

The Polish PM, among others, cites the carbon price as being the reason for high energy prices, blaming speculators in the process. I disagree.

Contrary to most other European countries, Polish electricity generation prices are much more dependent on hard coal prices than gas (70% of generation is hard coal/lignite). Hard coal prices increased from USD70/t (one-year forward API2) in Q121 to a peak of USD190/t in October 2021 and now trade at USD110/t, still way above Q121.

Because Poland is so dependent on coal, the carbon impact is, quite rightly, more severe: coal-fired electricity produces twice as much carbon as gas-fired electricity. So, Polish electricity prices have indeed suffered from a higher carbon price but also because the price of coal has risen remarkably – the impact split is about 50:50.

But let us not forget: the whole purpose of a higher carbon price is to trigger switching from more carbon-intensive processes (eg coal) to less carbon-intensive processes (eg gas and renewables).

And Polish (and other Eastern European) utilities have had free carbon allowances during 2013-20 which were not available to Western European utilities, ie they were treated leniently to help them move away from coal. In practice, little happened for many years (renewables is now c18% of generation).

When I look at German power prices, my analysis shows that carbon accounts for just 12% of the four-fold increase in German generation power price over the last 12 months. Gas, up eight-fold, is the culprit, accounting for 80%.

Gas prices account for 80% of the fourfold increase in generation costs – carbon just 12%:

In my view, the carbon price rally has been primarily driven by fundamentals, not speculation.

Significant legislative changes have markedly improved fundamentals.

The EU now has legally binding 2030 and 2050 climate targets. This is a firm commitment to reduce emission volumes. The EU’s prime weapon is the EU ETS. Despite being its “cornerstone policy”, it only covers 41% of emissions.

The Market Stability Reserve (MSR) mechanism came into effect on 1 January 2019. This results in enormous cuts in annual supply (auctions). It was brought into being specifically to push the carbon price up to a meaningful level, ie a level which would result not just in coal-to-gas switch for the power sector but also a reduction in industrial carbon emissions.

While the former has been successful (bar for short-term gas availability), the latter has not. In other words, the carbon price has been high enough to trigger coal-to-gas switching but not high enough to make it financially attractive for industry to reduce emissions.

Compliance is mandatory; non-compliance is penalised: On 30 April 2022, compliance entities under the EU ETS will have to deliver allowances to match their audited 2021 emissions. Failure to do so results in a €111/t penalty and still having to deliver those allowances in April 2023, on top of the allowances due for the emissions in the calendar year 2022. In 2023, the penalties will get worse: a 25% shortage of allowances in 2021 followed by an even larger 35% shortage in 2022, ie a cumulative 60%.

There is room for speculators

The EU’s European Securities and Markets Authority (ESMA) has, in its preliminary report, exonerated financial speculators as the “culprits” of the carbon price rally. Bravo ESMA: correct.

The full report is due in the coming months, but I would expect little change: the carbon price, in my view, has gone up due to fundamentals (implemented by the EU), not to “rampant speculation”, ie market tightening has been the principle driver of higher carbon prices – by the EU’s market design (the MSR).

The EU ETS carbon price could triple or quadruple

Even without the Fit for 55 package, I expect the EU ETS carbon price to breach the EUR100/t barrier in the coming months (from the current EUR80/t). In fact, I think it highly likely that the price will go well north of my average EUR118/t 2022 target.

Simply put, there is no clearing price for carbon: demand and supply do not meet. That, together with the draconian penalty, is enough to theoretically push carbon to infinity. Carbon is mispriced: there is just not enough analysis out there in this embryonic market.

That is beginning to change and, with it, a there is dawning realisation of the multi-year deficit this market is up against. With it, we might actually get a carbon price that forces industry to do what it should have done over the last 15 years: reduce emissions.

The key price driver is the multi-year trading deficit

There is a lot of noise currently in the carbon market, most of which is largely just that and detracts from market fundamentals. The crux is that the market is short supply. That is by far the overriding driver.

I forecast a 25% shortfall in supply versus emissions/demand in 2021, followed by 35% this year, 28% in 2023 and 23% in 2024 – which means that, cumulatively, there is a 111% deficit by 2024.

The multi-year trading deficit:

Demand: relatively stable

Demand/emissions picked up in 2021, boosted by increased emissions of c40mt from the coal to gas retrenchment (higher gas prices) and an estimated growth in industrial production/emissions of 3.9%.

For 2022. I expect demand/emissions to fall from 741m to 728m: higher industrial output (I conservatively assume 2.0% versus economists’ consensus of c3.0%) will be more than offset by power abatement from renewables.

In 2023 I expect a reversal of the gas to coal move in Q421/Q122 as well as the French nuclear shutdowns. Power abatement will be offset by growth in industrial emissions as well as a recovery in aviation. In other words, I expect demand to be relatively stable from 2023 onwards for a few years.

Note that I conservatively estimate 1.0% pa growth in industrial output from 2024-30; this is considerably below the 1.8% pa historical average.

Supply: significant curtailment makes this the key driver of the carbon price

But the carbon price development is a supply story: Supply dropped by one-third, 294m, in 2021 to 574m versus demand of 741m. I expect it to fall by a further 14%, 82m, to 493m this year, well below demand of 728m. Demand and supply do not reach equilibrium until 2028.

The deficits are primarily driven by cuts in supply/auction of allowances (m):

It is the orange line in the chart above that matters the most: the cumulative supply deficit just gets worse and worse. Consider what that means: a 100% cumulative supply deficit in 2024, ie all demand cannot find a single allowance to buy to comply – that happens in just three years’ time. And it goes on south to 139% by 2030.

Supply cuts are mechanical, driven by the MSR

The Market Stability Reserve (MSR) is a mechanism that, under certain technical conditions, withdraws supply from the market (by reducing pre-scheduled auction volume).

This alone will take 300m-350m allowances out of the market over the next four years – every year. Contrast this with my forecast trading deficit of over 200m pa. The deficit is unequivocally driven by supply reductions.

The MSR mechanism is formulaic. If the total float of allowances in the system (called TNAC, the total number of allowances in circulation) exceeds 833m, then the pre-scheduled auctions are reduced by 24% x TNAC.

At the end of 2020, TNAC was 1,579m. So, the MSR reduction would be 378m (in practice it is based on a two-year weighted average, so it was 323m in 2021). This year it gets bigger at 366m, ie 50% of demand.

The MSR drives down supply by an average 36% every year over the next five years (m allowances):

The MSR is a counterbalance mechanism to any recession

The MSR is also interesting because it is a counterbalance. The float of allowances (TNAC) rose in 2020 as supply (daily auctions and free allowances) did not change but emissions fell as industrial output reigned in, swelling the float of allowances – which increases subsequent years’ MSR reductions.

In other words, an economic recession might have an impact in that year but gets ironed out in subsequent years, so it is a kind of self-balancing recession-proof mechanism.

And if there are insufficient allowances in the system, deemed as less than 400m (TNAC), then 100m will be put back into the system: this happens in 2027, 2029 and 2030 on my estimates.

The MSR is a recession-proof mechanism (m allowances):

There is insufficient liquidity in the system

I estimate that there are not sufficient existing allowances to cover the deficit. Yes, there were 1,579m permits floating around the system (the TNAC) at the beginning of 2021.

But these are already part of, or being mopped up for, hedging by utilities, industry (and, to come, maritime), aviation and investors. This liquidity constraint, coupled with the annual supply-demand imbalance and stiff penalties, explains why I am so bullish on the carbon price.

There are now no spare permits in the system (m); pre-demand snowball effect:

Further tightening of supply is likely

The Fit for 55 package, currently being discussed by the EU’s Council and Parliament, is all about further tightening of the system. This shows the EU’s commitment to achieve emission reductions and save the planet.

The EU wants a 55% reduction of 1990 emission levels by 2030, up from the 40% prior target. Interesting, more onus has been put on the EU ETS system, which covers only 41% of EU emissions, to achieve a 61% reduction (thereby putting less onus on industries outside the system, predominantly agriculture, buildings and transport).

The Fit for 55 package has created a lot of noise. I assume it is enacted in 2024. It could happen earlier, which would worsen my 2023 28% deficit forecast to 36%. Consequently, the next three years’ deficits are almost exclusively driven by the MSR. Fit for 55, while interesting and laudable, is a driver of the carbon price in the longer term, not the short or medium term.

There are not sufficient allowances to enable compliance

There are not sufficient allowances to enable companies – and this is absolutely key. It means that there are not sufficient allowances to be bought by emitters to deliver to their governments to match their emissions every 30 April.

A brutal penalty price for non-compliance

The penalty price for non-compliance is brutal: not only do companies have to pay a penalty of €111/t (€100/t in 2013, revised by annual CPI) per allowance not delivered, but that non-delivered allowance has to be (bought and) delivered the following year.

Which means that in 2022, not only is there a 34% deficit, but compliance entities are also trying to buy the 25% not delivered for 2021 emissions. Thus the (cumulative) deficit is really 59% (which gets progressively worse as time goes on).

Unchecked, the carbon price goes to infinity

If there are not enough allowances to go around, which there are not, then that, together with the non-compliance penalty, unchecked, drives the carbon price to infinity. And this is a crucial point.

In the first instance, emitters are prepared to pay up to €111/t to avoid the penalty price. But once the allowances get to €111/t, emitters will still not have bought the allowances they require (there was, after all, a 25% deficit for the last calendar year, 2021).

They will then, if not beforehand, realise that the opportunity cost is indeed the €111/t penalty but also the price of the allowance which has to be bought for delivery the following year. So the opportunity cost is actually €222/t (since the allowances would then be trading at €111/t).

Hence the price of allowances goes to €222/t (there is not enough supply to meet demand). But then 22% of emitters will have not bought the allowances they need so their opportunity cost is now the €111/t penalty plus the cost of the allowances, now trading at €222/t – ie, €333/t. And so on to infinity. What will stop it going to infinity will be demand elasticity but, before that, I assume, it will take a political reaction.

There could be a political reaction, but it will take time

If the carbon price goes sufficiently high, the ensuing political reaction will likely be slow to occur. I assume the carbon price goes to €130/t by year-end before going to €150/t for Q123 and Q223.

Thereafter, I assume a retrenchment to an average of €114/t in 2024, due to political reaction, before climbing north again toward €150/t by 2030. In reality, the reaction could take much longer and, more likely, the carbon price will blow through those levels.

I predict a political reaction kicking off at the price which creates the intensity of the (ongoing since Kyoto 1997) political debate. Simply for argument’s sake, let’s call that price €150/t. The price needs to be there for at least one quarter for the market to realise it is not a one-off aberration.

Then the EU Commission must realise it has to come up with a proposal, write it and table it. By way of example, it took nine months for the Fit for 55 Green Deal package proposal to be put together. Then it goes to EU Council, requiring c70% approval by the 27 members.

Then it goes over to the EU Parliament for 50% approval by its 27 members. If Parliament wants its stamp of approval, it goes back and forth, a maximum of three times. Then Council, Parliament and the Commission reach a trilogue agreement. Then they find a spare plenary session where it can be voted through. Then enacted. Then rolled out.

The whole process will take time; it will probably take three years for the Fit for 55 Green Deal to be fully enacted. It took four years for the MSR approval.

And it should take time: the EU has the principle of legitimate expectation enshrined in law which means, in plain speak, that if it shifts, in this case, the carbon goal posts, it can be sued (you have a legitimate expectation that you can trade on an enacted law and that it won’t change, at least not abruptly).

The EU desires neither of these outcomes and has shown, over time, that everything is done deliberately; the MSR (four years in the making) and Green Deal (likely three years) being proof. The EU wants the market to set the price: a fast move would kill the carbon market and, I think, they know that (nor do they have the desire to do so).

But EU ETS carbon price has to be well into triple figures to have an impact

Since demand and supply do not intersect and, unchecked, carbon goes to infinity, economics 101 does not work. I look at the potential carbon price in two ways:

Politics: The head of EU Climate, Frans Timmermans, has publicly stated that the carbon price needs to be well north of €50/t. In Germany, the industrial heartland of Europe, the new government has stated that it wants a carbon floor of €60/t (should the price fall below that it would buy allowances). EU Greens target €150/t, as does the Bank of England. Norway is calling for a price of €200/t.

Corporates: One of the most efficient chemical companies in Europe, BASF, has implied that a carbon price south of €140/t will not incentivise carbon reduction (so it presumably needs the price to be north of €140/t and sustainably so). Added to this, a leading cement player, HeidelbergCement, put that number at €120/t. A leading insurance company, Swiss Re, uses a carbon price of €200/t. And shipping companies are talking of needing the carbon price as high as €150/t.

The demand snowball effect: many will try to buy more allowances

I have not factored in the snowball effect into my model. However, it is a distinct possibility. The snowball effect happens as follows.

Industrial companies wake up and smell the (carbon) coffee: the cost of carbon becomes significant (lower free allocations from 2021, 80% instead of 90% plus a higher carbon price). The best strategy is to hedge themselves against higher carbon prices and carbon allowance scarcity. So, industrials will (try to) buy more carbon allowances.

Power companies will face increased demand from consumers for longer-dated electricity contracts. They will be happy to oblige. Having fixed the power price, they will want to fix their fuel costs and their carbon cost. So, power companies (try to) buy more carbon allowances.

Aviation, once traffic volumes recover, will also come to the realisation that they need to protect themselves. So, airlines will (try to) buy more carbon allowances.

Maritime joins the EU ETS system in 2024. Shippers are already working out that they need to protect themselves. So, shipping companies (try to) buy carbon allowances.

Financial investors, seeing that market participants are waking up to the supply deficits will also position themselves accordingly. So, financial investors will (try to) buy more carbon allowances.

Retail will eventually come into the market. Although difficult at the moment for retail investors to buy carbon allowances, I believe it is only a matter of time before they can sit around the dinner table and brag about the allowances they have bought to reduce their carbon footprint and make the world a better place. So, retail will (try to) buy more carbon allowances.

Net zero compliance should also trigger more allowance buying. Carbon allowances are far better at doing what they say on the tin than many voluntary carbon offset projects. Corporates are waking up to this alternate EU ETS asset class which will help them achieve their net zero targets. The same applies to financial investors – and, for that matter, utilities. So, more companies will (try to) buy more carbon allowances.

Do not forget, EU ETS’s €50bn+ revenues are a godsend

Not much is said by the EU and member countries about the revenues that the EU ETS system generates, but annual auctions of c600m allowances generate, at today’s price of €80/t, €50bn of pseudo tax revenues.

To give this number context, it is larger than the UK’s €40bn Brexit bill. But it recurs annually: it is an annuity. And if I am right in my forecasts, it could triple or quadruple.

These revenues are all distributed to every one of the EU’s 27-member finance ministries, with the sole stipulation that at least 50% should be invested in climate-related projects (a fairly weak requirement, in my view).

That is a considerable amount of money, more so in these tight fiscal times. It also affords, should the countries choose, significant funds to help industries modernise and/or innovate (on top of which there are two specific funds set up just for this).

Germany, for example, is partly funding the removal of the EEG surcharge from energy bills through the state budget, supported, of course, by higher carbon auction revenues.

So, when a country says it is against a high carbon price, the finance ministry will likely not agree – Poland included, which has the largest share, 17%, i.e., more than €8bn at current prices – year in, year out (well, increasing if my forecasts are right).

This is a superb, vast and timely stealth tax – at least from the point of view of the beneficiary countries and EU.

EU ETS revenue share by country (top 8):

Finally, the EU should be brave and not afraid of high carbon prices: they are needed to achieve their 2030 goal. I won’t pontificate – lord knows you’ve done well to read this far – probably the only reader.

Right, if you got this far, your coffee must now be drained and brain overflowing – time to rebalance the two. Till the next time. Be safe, be healthy, be fun. Do good.

PS: these are all my views and I could be completely wrong so don’t rely on them

Original article appeared on LinkedIn HERE

The post Left Unchecked – The Carbon Price Goes to Infinity appeared first on Carbon Credits.